TORONTO, ON / ACCESS Newswire / July 29, 2025 / Highlander Silver Corp. (TSX:HSLV) (“Highlander Silver” or the “Company“) is pleased to report assay results from the first seven holes drilled to test a conceptual open pit target along a ridgeline where the Bonita vein system is exposed 10km to the south of the Ayelen underground deposit at its San Luis gold-silver project in Central Peru.

Highlights are listed below, with corresponding images in Figures 1-2 and detailed results in Tables 1-2.

Highlights

-

The first seven holes follow up on and step out from two historical holes (BOD-001 and BOD-002), with every new hole returning high grade gold-silver mineralization over a broad width from near surface

-

BOD-003 returned 14.5m of 3.70 grams per tonne (“g/t”) gold (“Au”) and 17.47 g/t silver (“Ag”) from 25.7m downhole and 4.1m of 5.34 g/t Au and 43.22 g/t Ag

-

BOD-004 returned 16.9m of 4.42 g/t Au and 7.61 g/t Ag from 24.7m downhole, including 3.3m of 15.15 g/t Au and 14.08 g/t Ag

-

BOD-007 returned 20.0m of 3.78 g/t Au and 12.31 g/t Ag from 4.0m downhole

-

BOD-008 returned 23.1m of 4.92 g/t Au and 16.56 g/t Ag from 4.7m downhole, including 13.0m of 7.11 g/t Au and 19.90 g/t Ag

-

BOD-009 returned 47.8m of 1.87 g/t Au and 13.49 g/t Ag from surface, including 2.1m of 12.55 g/t Au and 41.2 g/t Ag

-

A total of 13 holes have been completed to date with assays pending for the balance; drilling is ongoing with one drill rig and regulatory approval has been recently obtained to expand the program to include a second drill rig

-

The Bonita vein system is located 10km to the south and 700m lower in elevation than Ayelen. It is exposed in outcrop over an area of 800m by 200m and remains open in all directions

Mr. Daniel Earle, President and CEO, commented: “It’s encouraging to see consistent broad intersections of high grade gold-silver mineralization in shallow step out drilling, particularly from a starting point of only two historical holes. As we continue reporting results, we’re also working to lay the foundation of social support, regulatory permitting and knowledge won from systematic exploration to scale our operations to build momentum through the second half of the year.”

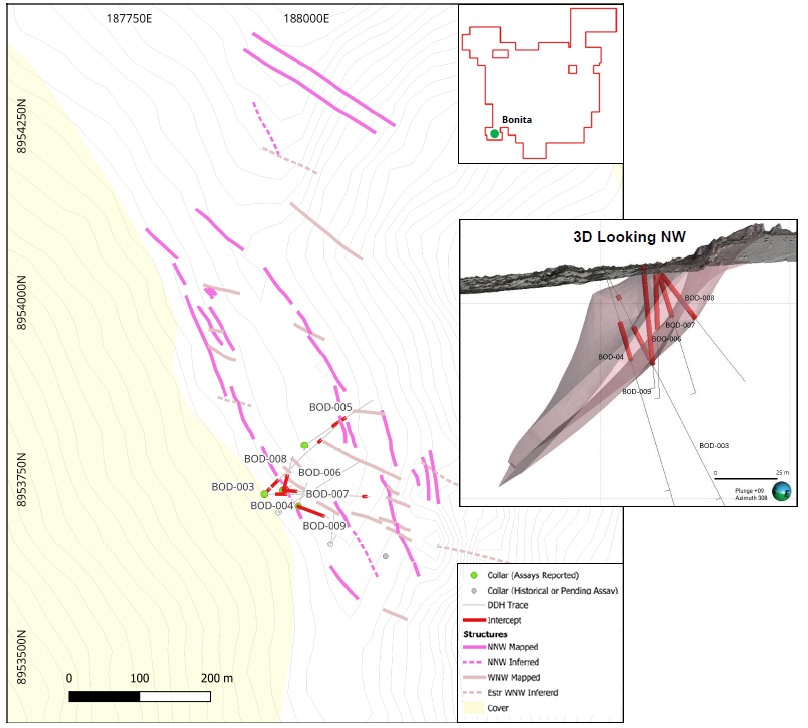

Figure 1 – Plan View of Bonita Vein System

Figure 2 – Image of core from BOD-004 at 35m grading 17.30 g/t Au and 15.10 g/t Ag

Table 1 – Assay Results

|

Hole ID |

From |

To |

Interval |

Au |

Ag |

|

BOD-003 |

12.0 |

14.2 |

2.2 |

0.85 |

12.89 |

|

and |

25.7 |

40.2 |

14.5 |

3.70 |

17.47 |

|

and |

165.0 |

169.1 |

4.1 |

5.34 |

43.22 |

|

BOD-004 |

24.7 |

41.6 |

16.9 |

4.42 |

7.61 |

|

incl. |

33.7 |

37.0 |

3.3 |

15.15 |

14.08 |

|

and |

193.5 |

196.5 |

3.0 |

0.67 |

2.55 |

|

BOD-005 |

68.7 |

80.6 |

11.9 |

2.09 |

2.32 |

|

and |

92.5 |

95.0 |

2.5 |

0.55 |

15.98 |

|

BOD-006 |

2.5 |

24.5 |

22.0 |

1.86 |

6.91 |

|

BOD-007 |

4.0 |

24.0 |

20.0 |

3.78 |

12.31 |

|

BOD-008 |

4.7 |

27.7 |

23.1 |

4.92 |

16.56 |

|

incl. |

12.3 |

25.3 |

13.0 |

7.11 |

19.90 |

|

BOD-009 |

0.2 |

48.0 |

47.8 |

1.87 |

13.49 |

|

incl. |

29.7 |

31.8 |

2.1 |

12.55 |

41.20 |

Note: Reported intervals are apparent widths as the full geometry of the mineralized structures has not yet been fully modelled. Assays were not capped, and composite intervals are calculated using a minimum weighted average of 0.5 g/t Au, diluted over a minimum core length that allows for internal dilution. Included high-grade intercepts are reported as any consecutive interval with grades greater than 5 g/t Au.

Table 2 – Collar Locations

|

Hole ID |

Easting (m) |

Northing (m) |

Elevation |

Depth |

Azimuth |

Dip |

|

BOD-003 |

187941 |

8953730 |

3953 |

225.6 |

44 |

-50 |

|

BOD-004 |

187941 |

8953730 |

3953 |

206.0 |

90 |

-45 |

|

BOD-005 |

187998 |

8953799 |

3986 |

160.3 |

55 |

-45 |

|

BOD-006 |

187967 |

8953735 |

3961 |

51.0 |

60 |

-75 |

|

BOD-007 |

187967 |

8953735 |

3961 |

60.3 |

95 |

-40 |

|

BOD-008 |

187968 |

8953734 |

3961 |

65.0 |

15 |

-40 |

|

BOD-009 |

187989 |

8953712 |

3964 |

60.0 |

110 |

-40 |

Technical Information and Quality Control / Quality Assurance

All drilling was completed with HQ core. The drill core is split in half using a diamond saw. Core is logged by the Company’s geologist on site who outlines the intervals to be sampled. The maximum sample length is 1.5 meters and lengths are adjusted according to lithological and/or mineralogical contacts.

After sawing, one-half of the core is kept on site in core boxes, and the other half is submitted for analysis. Individual sample bags are sealed and placed into larger bags, which are then sealed and marked with the contents.

Samples are transported by Highlander Silver personnel to ALS Peru S.A. (“ALS“) located in Lima, Peru, where they are prepared and analyzed. ALS is independent of the Company.

In ALS, the entire sample is crushed to approximately 80% passing through a 2mm sieve. A 500 g fraction is pulverized. Gold concentration is determined by fire assay of a 30-gram charge with an AA finish (Au-AA23). Silver, lead, copper, and zinc, along with other elements, are analyzed by ICP utilizing a four-acid digestion (ME-ICP61). Over-limit samples for Au (10 g/t Au) follow gravitational finishing Au-GRA21 (30g sample). Over-limit samples for Ag (100 g/t Ag) follow gravitational finishing Ag-GRA21 (30g sample).

The internal QA/QC program includes the submission of field duplicates (1/4 core), pulp and coarse reject duplicates, and the insertion of commercial standards and blanks (coarse and fine). Control samples account for more than 15% of the total samples sent, in addition to the laboratory’s internal quality assurance programs.

The Company is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data referred to herein.

The scientific and technical information, including the drillhole data, has been verified by Dr. Sergio Gelcich. This verification involves data validation and quality assurance procedures, such as reviewing logging directly in front of the core, analyzing database integrity, conducting quality assurance and quality control (QA/QC) for assays, and cross-checking the original lab certificates.

Qualified Person

The scientific and technical information in this press release has been reviewed and approved by Dr. Sergio Gelcich, P.Geo., Vice President, Exploration, Highlander Silver, who is a “Qualified Person” as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects.

On behalf of Highlander Silver

“Daniel Earle”

President & CEO, Director

Information contact

Arun Lamba, Vice President Corporate Development

alamba@highlandersilver.com

About Highlander Silver

Highlander Silver is primarily focused on advancing the bonanza grade San Luis gold-silver project that is located adjacent to the past-producing Pierina mine in Central Peru. San Luis hosts Indicated Mineral Resources of 356 koz Au at 24.4 g/t Au and 8.4 Moz Ag at 579 g/t Ag and ranks among the 10 highest grade projects globally in both gold and silver categories.1 The Company’s significant shareholders include the Augusta Group, which boasts an exceptional track record of value creation totaling over $4.5 billion in exit transactions, and strategic shareholders, the Lundin family and Eric Sprott.

1S&P Global rankings including the San Luis gold-silver project.

The scientific and technical information contained herein is derived from Highlander Silver’s technical report titled “Technical Report on the San Luis Property” with an effective date of January 15, 2025, prepared by independent qualified person, Martin Mount, MSc MCSM FGS CGeol FIMMM Ceng, and available on SEDAR+ at www.sedarplus.ca.

Forward-looking statements

Certain information contained in this news release constitutes “forward-looking information” under Canadian securities legislation. This includes, but is not limited to, expanding the program to include a second drill rig; and the that Company is laying the foundation of social support, regulatory permitting and knowledge won from systematic exploration to scale operations to scale our operations to build momentum through the second half of the year. Such forward looking information or statements can be identified by the use of words such as “ramp up”, “attempting”, “intends”, “believes”, “plans”, “suggests”, “targets” or “prospects” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “will” be taken, occur, or be achieved. Forward-looking information involves known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of the Company and/or its subsidiaries to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking information. Such factors include, among others, general business, economic, competitive, political and social uncertainties, the actual results of current exploration activities, changes in project parameters as plans continue to be refined, future prices of precious and base metals, accident, labour disputes and other risks of the mining industry, and delays in obtaining governmental or stock exchange approvals or financing. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that could cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking information contained herein are made as of the date of this news release. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking information if circumstances or management’s estimates or opinions should change, except as required by applicable securities laws. Accordingly, the reader is cautioned not to place undue reliance on forward-looking information.

SOURCE: Highlander Silver Corp.

View the original press release on ACCESS Newswire